Unifying 20 payment silos to help Kenya's third-largest bank compete in a 97% digital market

Client

Model

services

info

Kenya's third-largest bank faced an existential challenge: transform digitally whilst 70% of IT budgets remained trapped in legacy systems. With more than 80% of Kenya adults adopting mobile money platforms, NCBA's complex, fragmented infrastructure across 20+ payment methods threatened its competitive position.

challenge

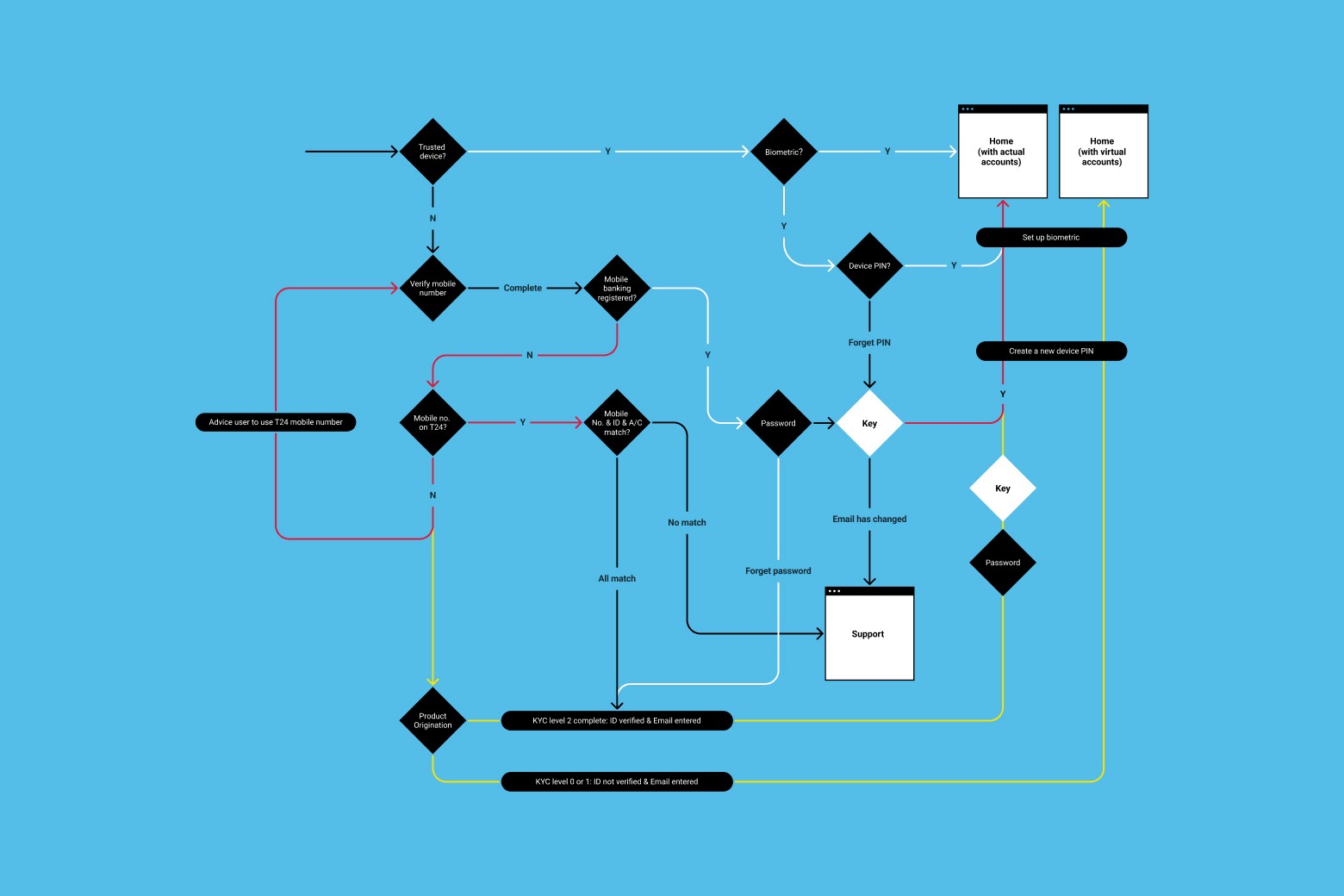

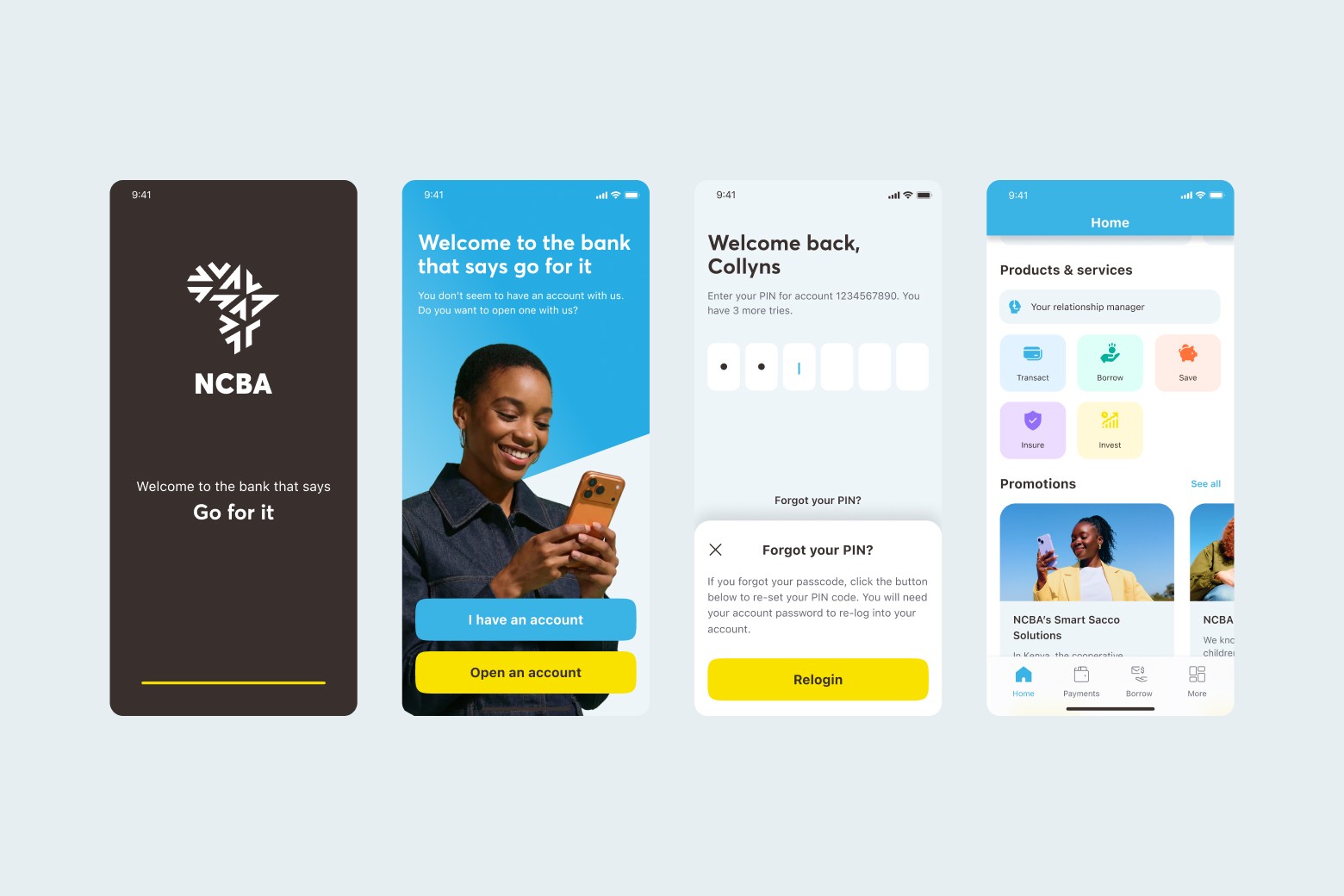

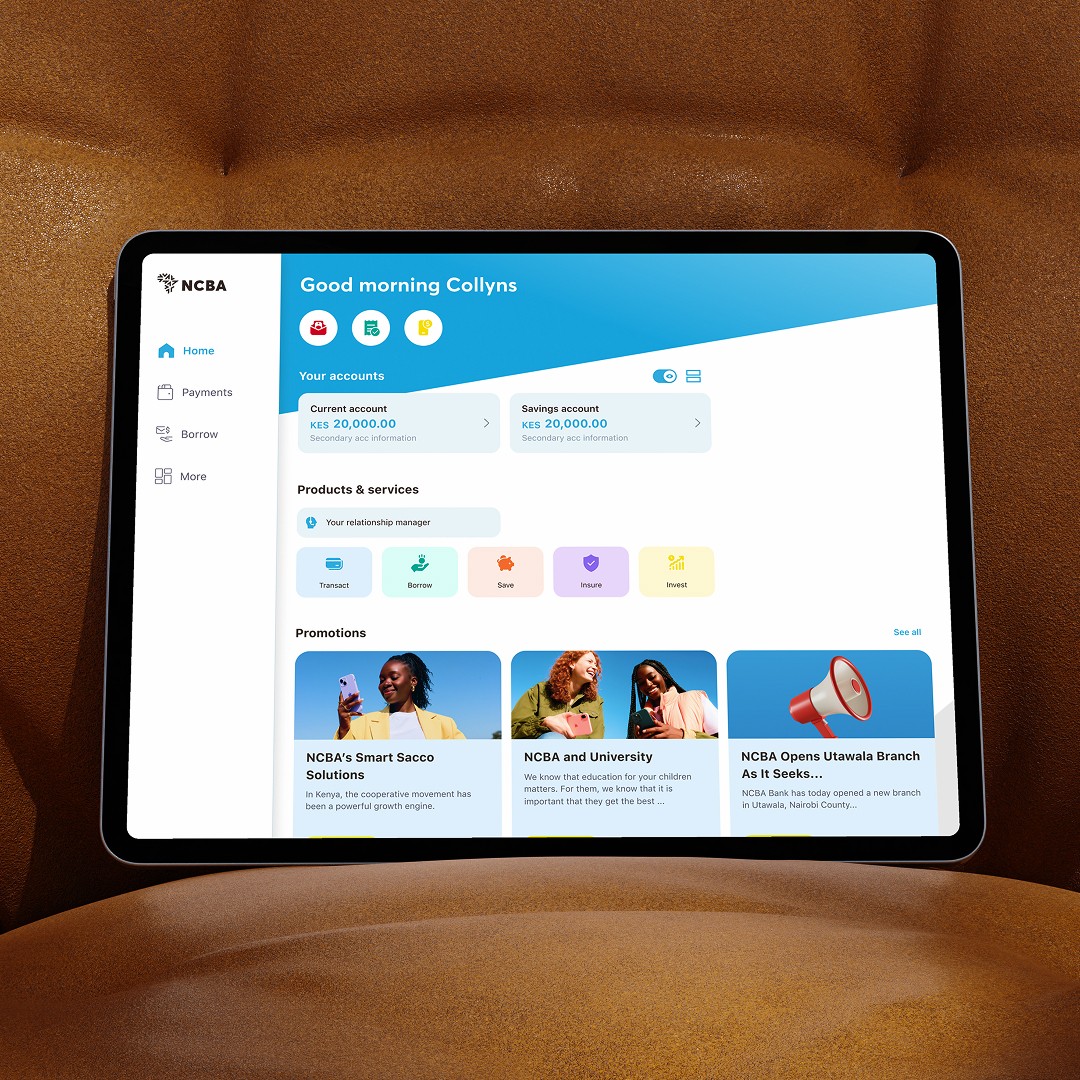

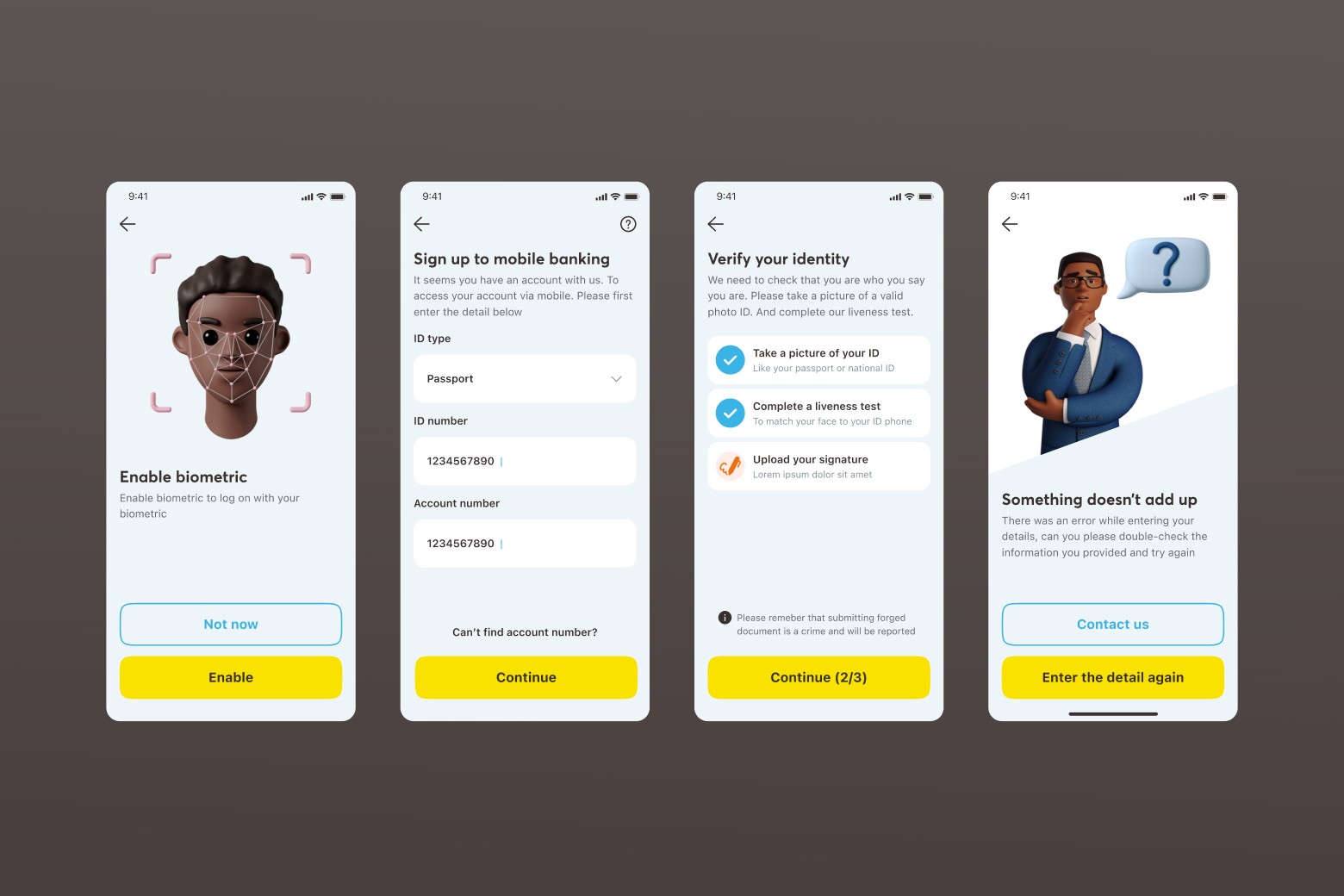

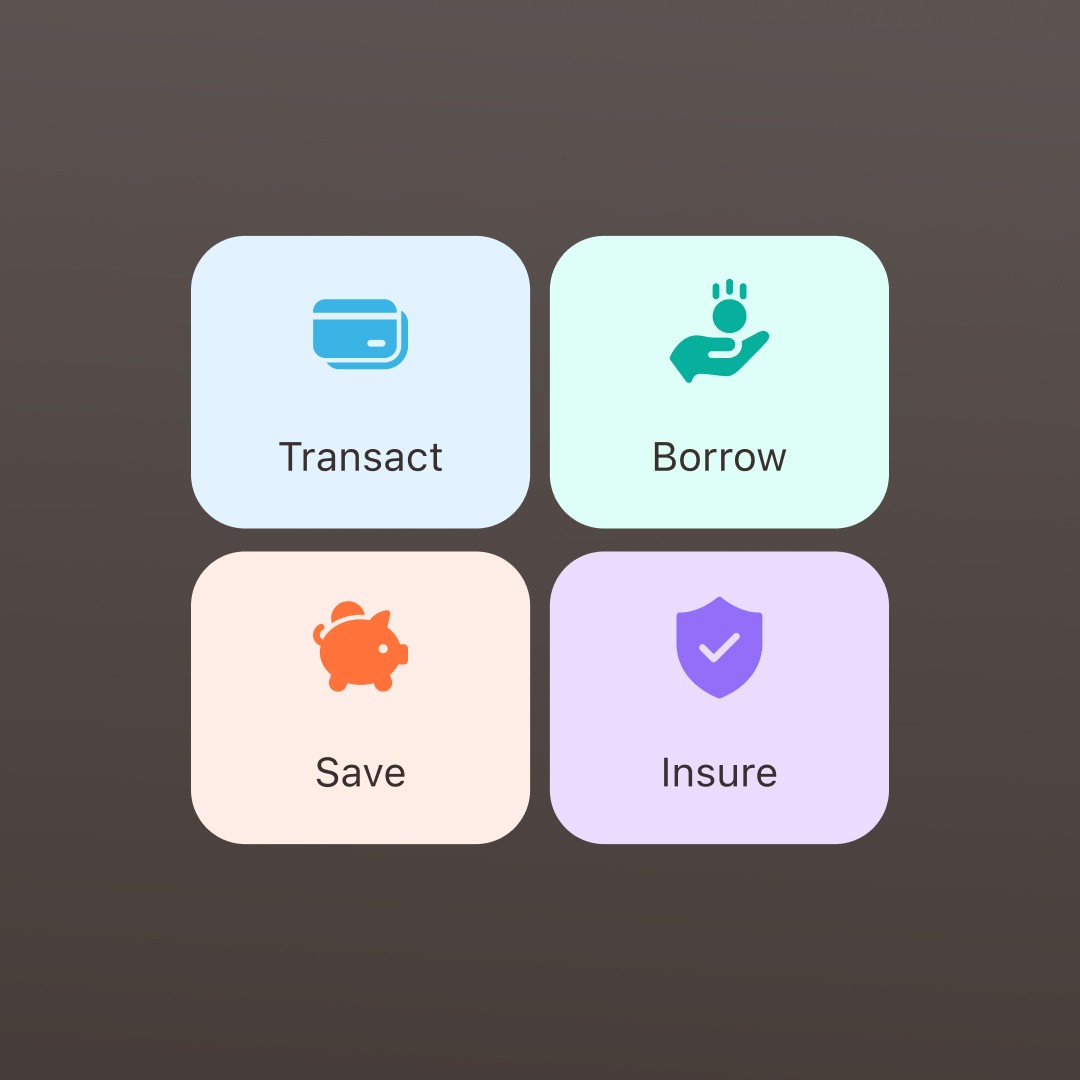

Kenya's fragmented payment landscape meant NCBA needed to integrate 20+ different methods—from M-Pesa to SWIFT—without a full rebuild. But with mobile money 80% cheaper than banking and M-Pesa controlling 66% of payments, NCBA couldn't just connect systems. They needed unified UX architecture that made payments seamless regardless of method.

our analysis

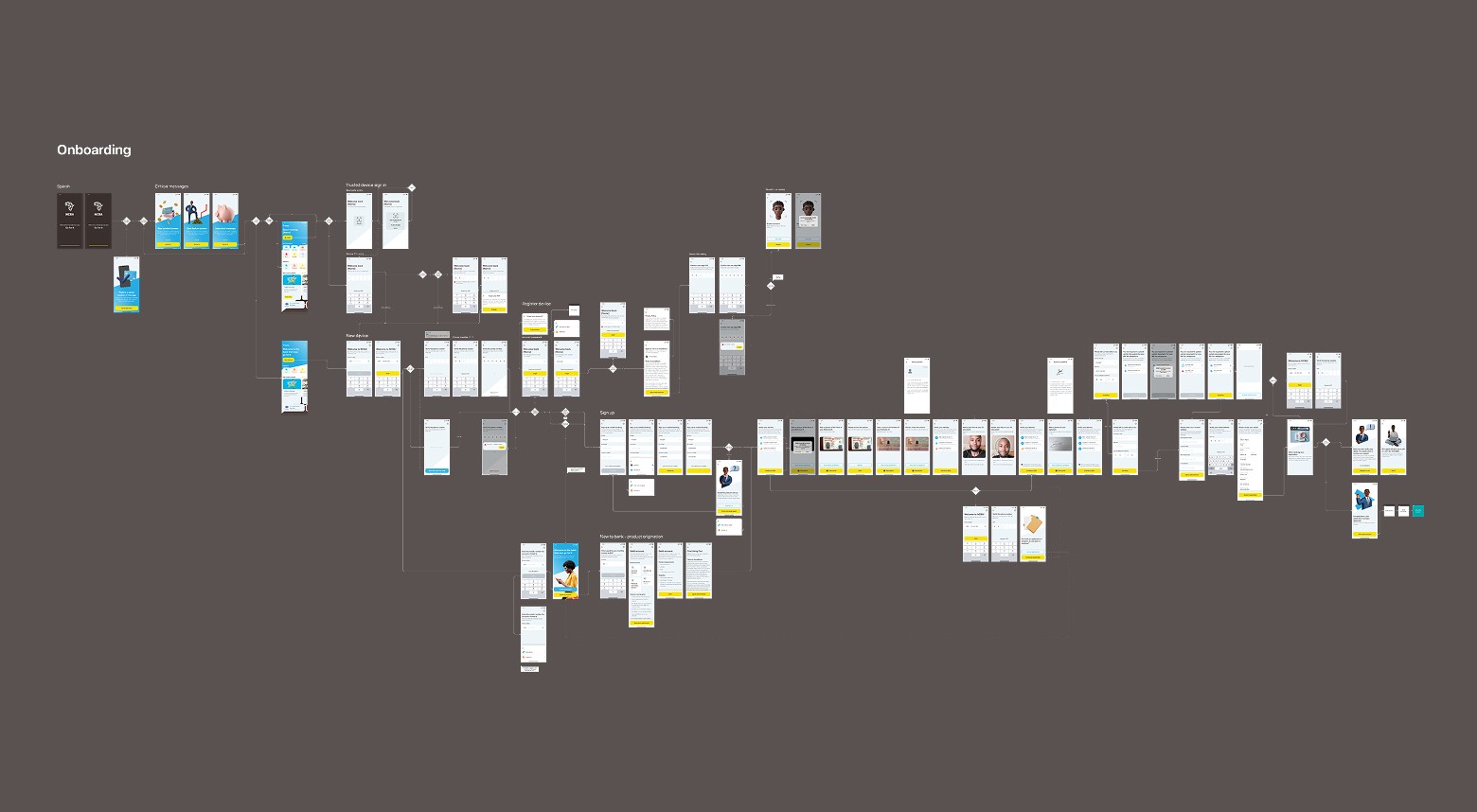

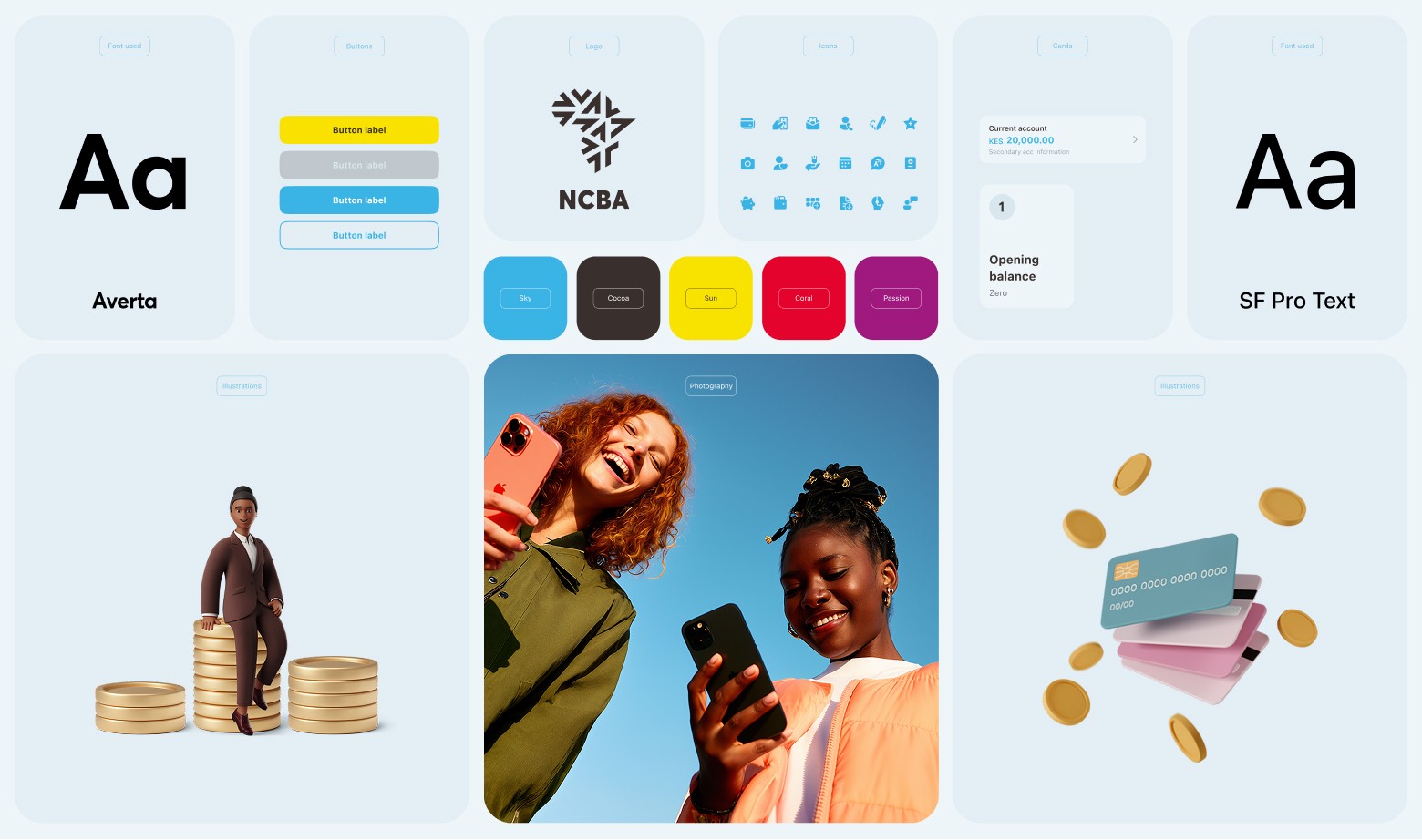

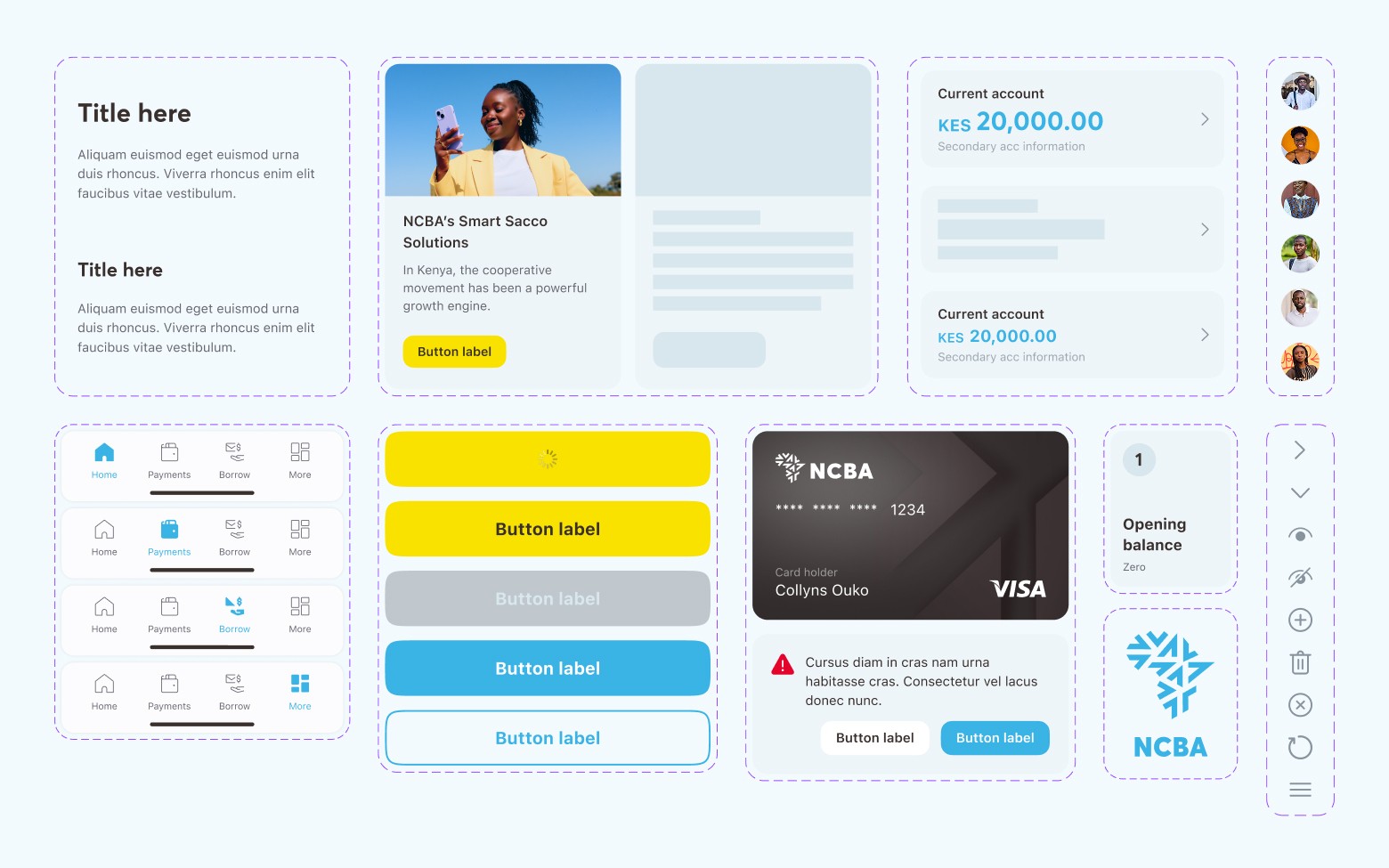

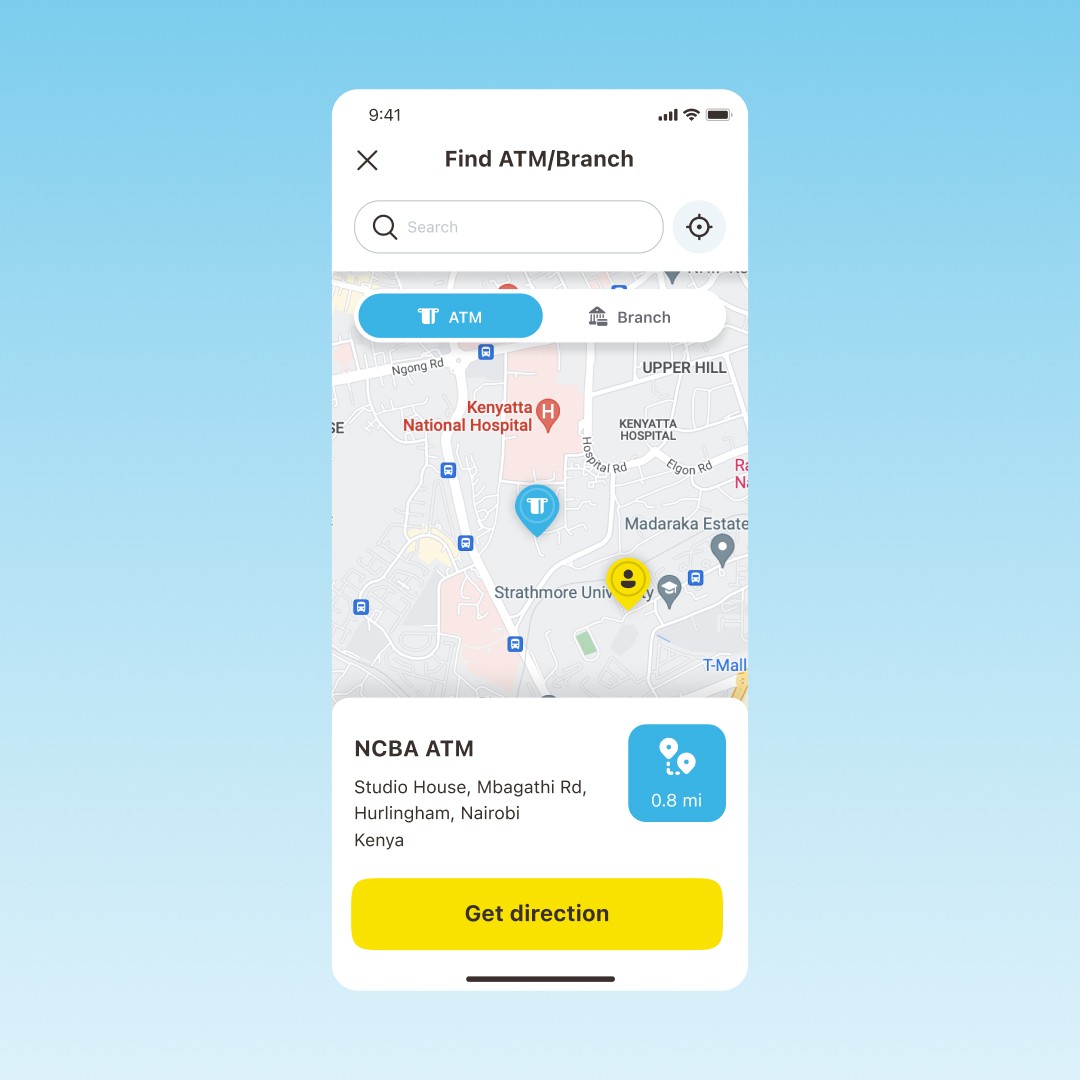

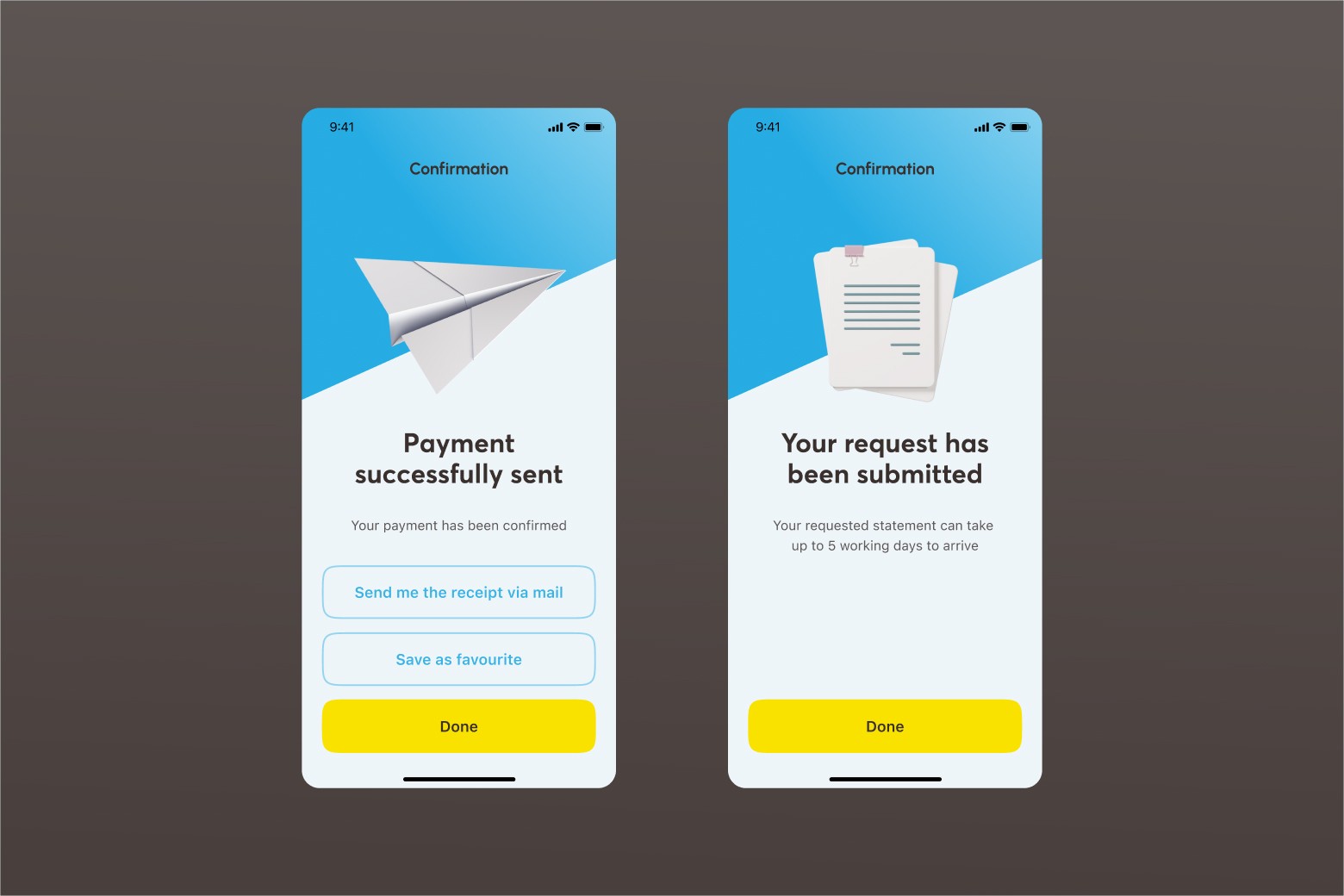

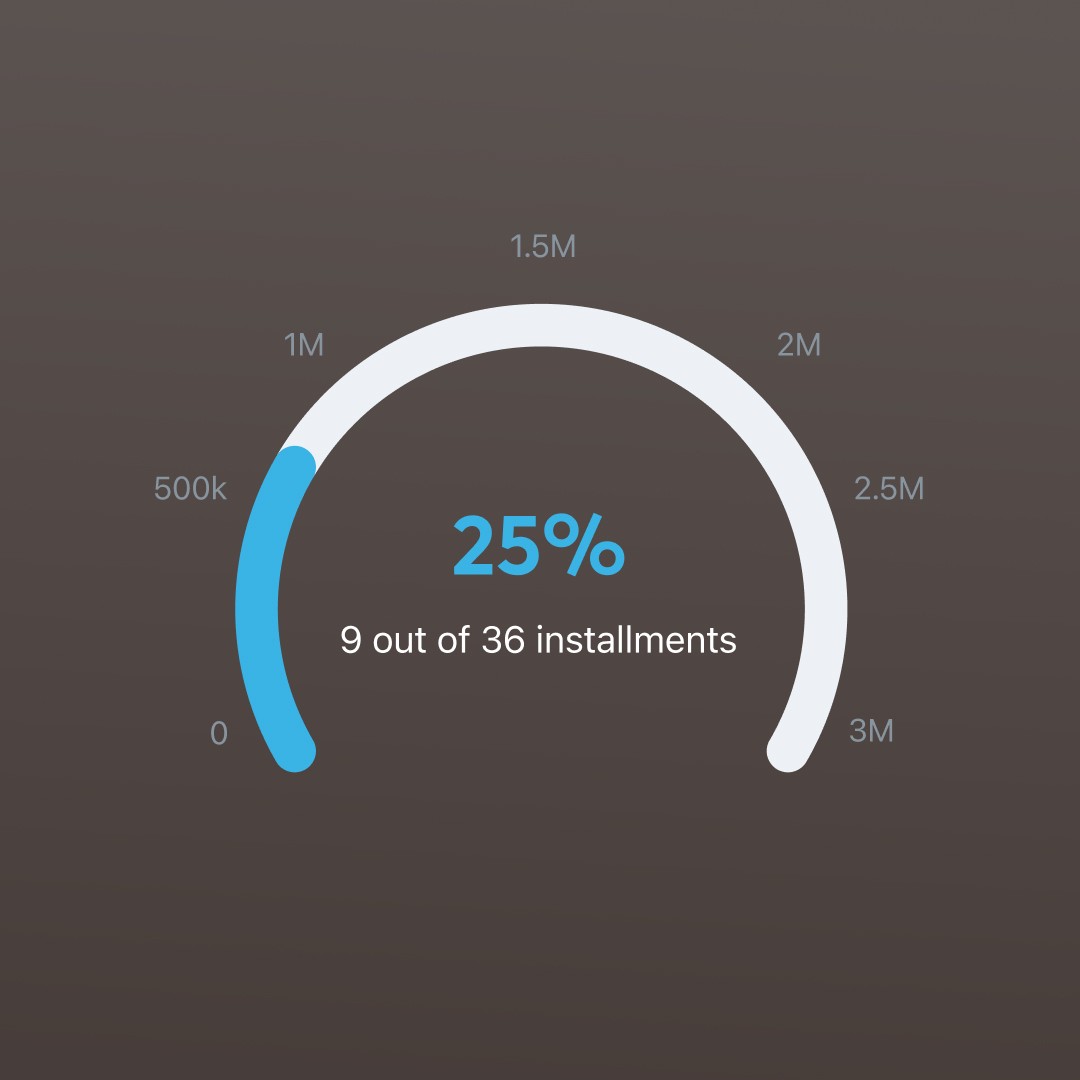

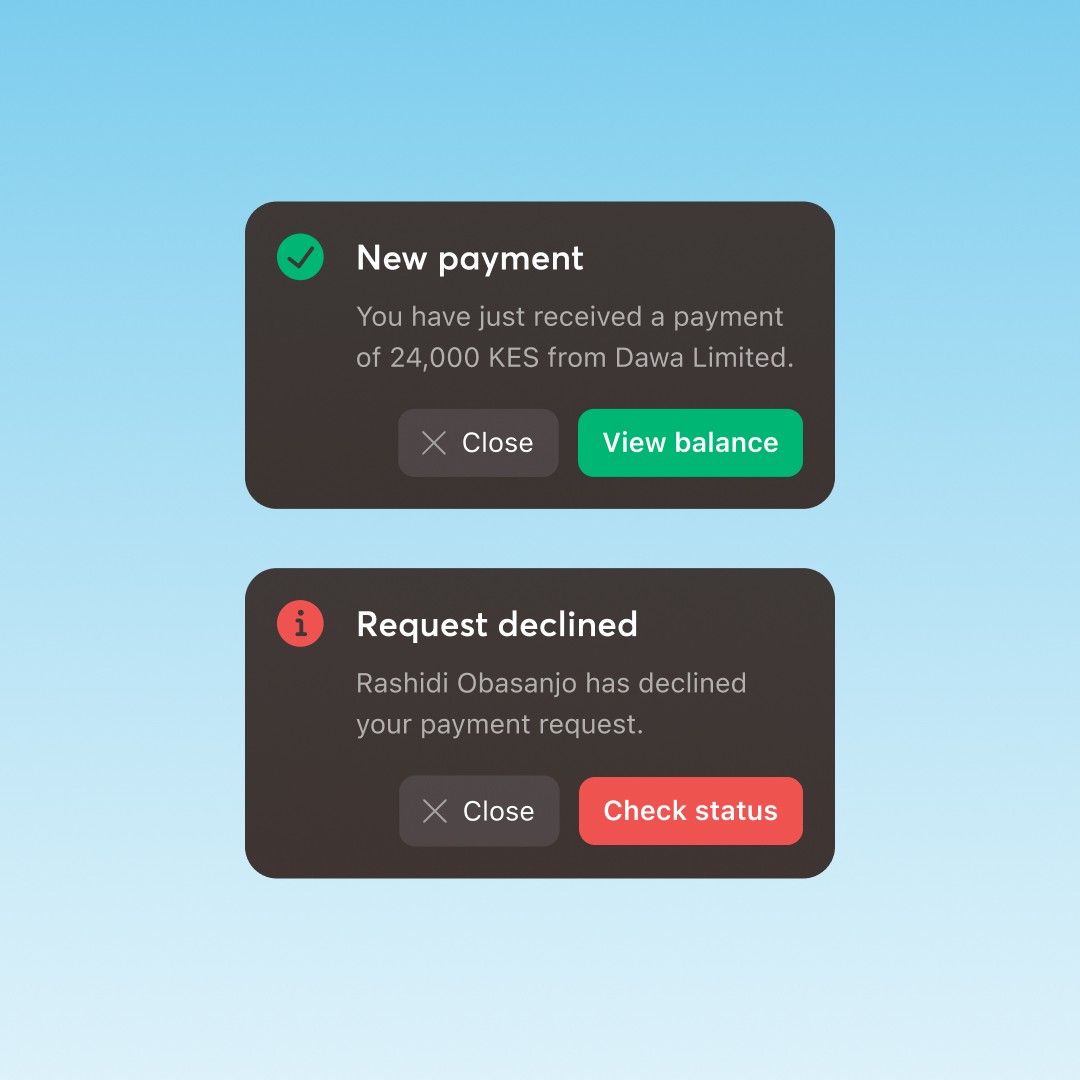

Success meant one interface handling significant complexity. The real challenge wasn't the number of payment methods but the prioritisation of features. Users needed the right option at the right moment, not every option. Mapping usage patterns revealed how to hide complexity without limiting functionality. An intelligent, context-adaptive interface transformed NCBA into a unified financial platform.

what we did

project impact

Need to unify fragmented or complex user experiences?

We help ambitious, scaling companies break free from legacy constraints through embedded expertise, sprint-based accelerators and evidence-based design. Our approach combines strategic presence with scaled execution—proving that the right expertise, properly positioned, delivers what armies of consultants cannot.